Yesterday, I explained why Scranton’s 2014 budget is broken. Today, I am going to offer a potential solution.

There’s a whole truck load of disclaimers here:

- Yes, the Union contracts are good through 2017 and I am contemplating altering them before that date. But one of Courtright’s biggest campaign promises was that the Unions would negotiate with him.

- No, you can’t unilaterally restructure debt. And the Evans/Hughes 2012 debt issue may be the hardest of all with its “guaranteed interest” clause.

- Yes, there may some questions about the tax status of the restructured debt. But the necessary changes to State rules should be easier than getting approval for a $2.3B tax hike.

- No, I don’t think the tax payer gets out of this unscathed. But this proposal does “spread the pain around” as much as possible.

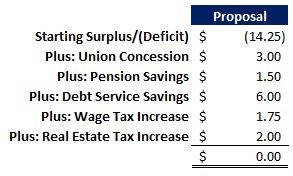

With all of that out-of-the-way, here it is:

And here’s what it all means:

Union Concessions: Courtright promised the Unions would work with him and only him. Here’s the chance. This “restructure” has three prongs. First, implement pay freezes beginning in 2015 (they’ll come back by 2018). Second, replace 20 police officers (via retirement over three years) with lower cost new hires. Third, increase employee contribution to healthcare by 10% (phased in at 3% per year beginning in 2015).

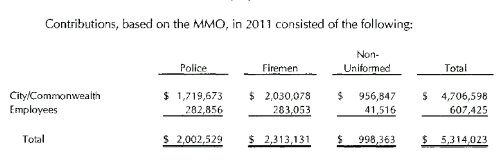

Pension Savings: By capping the maximum payable benefit and capturing the savings from the 20 new “lower cost” officers, Scranton can save about $1.5 million Revised terms would cap pension benefits at 60% of average salary (based on the last five years of service) or $35,000. In exchange for the concession, Scranton will make an “pre-fund” pension contributions through 2017.

Debt Service Savings: restructure the debt. A big part of Scranton’s problem is it’s lumpy debt service schedule. By spreading out the principal repayment schedule and reducing interest rates (from 8.5% to 7% – hopefully), the city should be able to reduce their annual debt service by 40%.

Wage Tax Increase: Increase wage tax from 2.4% to 2.75%. I’m sorry. But this equates to roughly $75 on average.

Real Estate Tax Increase: 10%. Possibly 7.5% if we can get our realization rate up.

It’s important to keep future real estate rate increases to a minimum. Beyond the issue with collecting the current balance, tax hikes impact real estate values. With household incomes stagnating around $37,000, most households have a monthly maximum mortgage payment of about $850. If Scranton’s tax – which currently totals $65 per month – increases by 15%, the “monthly” escrow in your mortgage payment increases by about $10. Since wages aren’t increasing, that means other portions of the mortgage payment have to give. Reducing the Principal and Interest component of the monthly payment by just $10 decreases the “purchasing power” by $2,000.

Let me phrase that another way: for every 15% increase in the city’s real estate tax, home values decline by $2,000 (if wages do not increase).